August 26, 2015 @ 3:06 PM

How to handle when a customer gives you a bad check or a bogus credit card charge that is taken back a few days later when you are using a point of sale program like The Edge; Jewelry Shopkeeper or any other point of sale program

I’ve had many a jeweler contact me after the fact when a customer’s check bounced or as what happened this week when a large sale was made with a credit card and days later the processor took the money back. This was fraud after the fact.

The jeweler mistakenly thought if the money “bounced” or was taken away that he should refund the sale in the Edge (or any other POS system).

No money obviously no sale, reverse it - right?

WRONG

The only time to reverse or refund a sale is WHEN THE CUSTOMER GIVES YOU THE MERCHANDISE BACK AND IT GOES BACK INTO STOCK!

It’s still a sale. Have you ever let a customer walk out without paying with the promise to pay you next month? Sure and that’s an accounts receivable sale. A sale was made and no money was received but we now have a customer owing us money. Just like when you go to the Vegas show. You buy stuff and for the vendor it’s a profitable sale. Instead of a cash sale he logs in an accounts receivable sale.

So when a check bounces or a credit card bounces (like it did for this store) then this is 100% an accounting side event. If you use QuickBooks all of this happening affects QuickBooks and you don’t refund or void the sale in Edge/Shopkeeper/Arms/Cams or any other program.

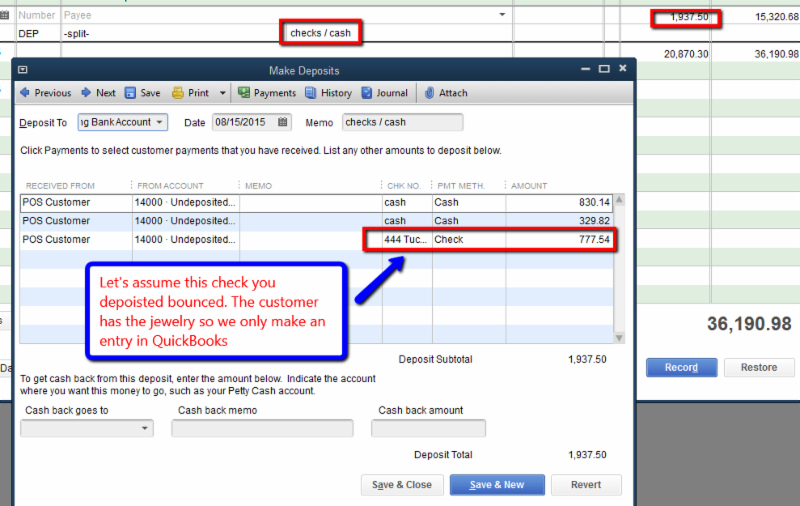

Here’s how to handle it. In QuickBooks this check was returned by the bank.

First thing to do is what the bank did and that’s to remove it or lower our bank balance. We'd remove the amount of the bad check or the credit card fraud amount.This is a new entry. Do not do anything to the original deposit shown above.

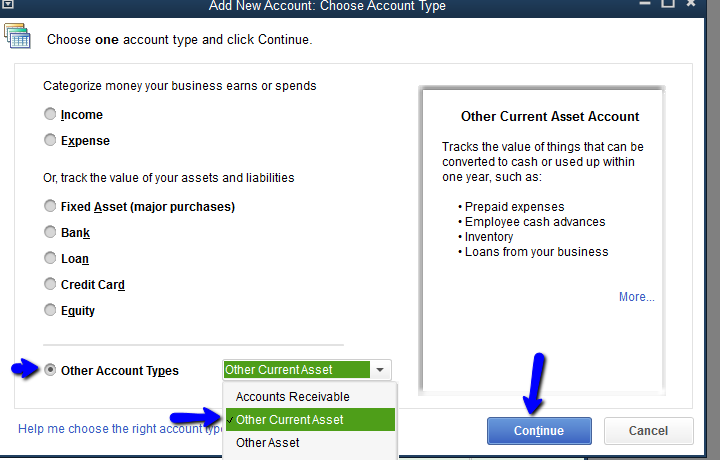

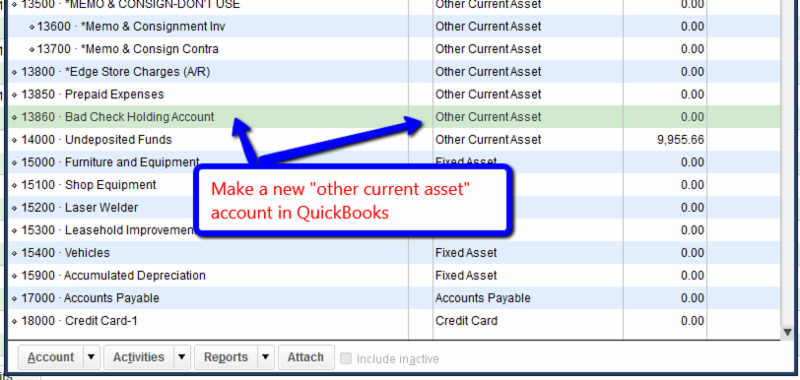

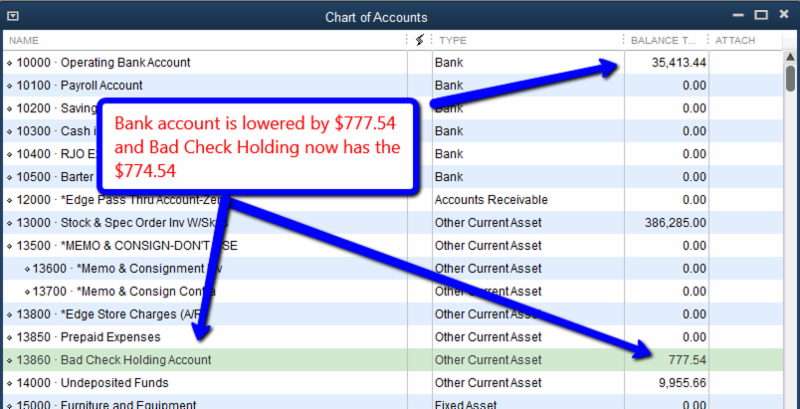

We need an “other current asset account” called “Bad Check Holding Account”.

Simple to do. Go to your Chart of Accounts (Control+A). Then hit “Control+N” for new account. Choose “other account” types; then “other current asset” and “next”. On the next page give it a number if you use numbers and in the description box type the name “Bad Check Holding Account” and click OK at the bottom.

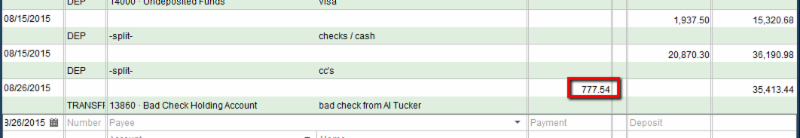

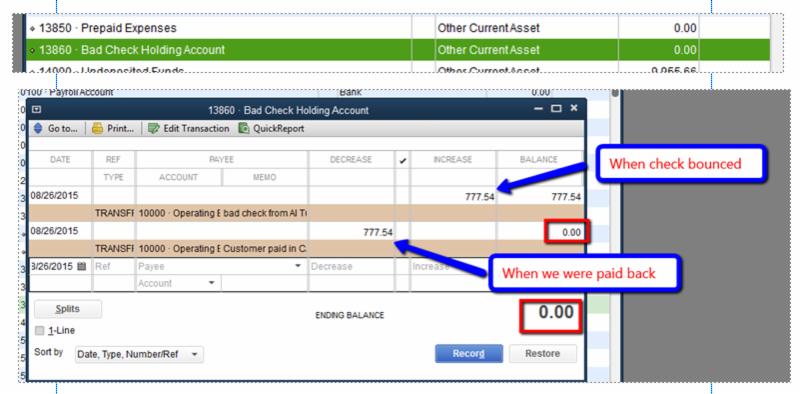

So just make an entry in the check register for the amount (our example is $777.54) in the payment column. On the 2nd line for account choose your “Bad Check Holding Account”. What you’re doing is lowering the bank balance and putting this amount in a temporary holding account until you get paid.

Your chart of accounts will look like this after the entry.

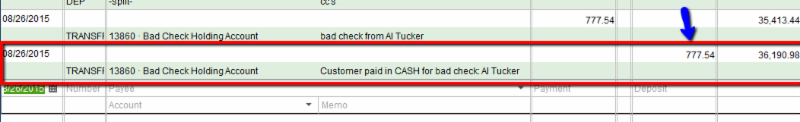

Now we wait while you collect. When we do get out money back (either check reimbursement or the credit card comes thru again) this has nothing to do with the POS system, just QuickBooks. All we do is make a deposit fromthe Bad Check Holding Account into our regular bank account. Let’s assume it’s a deposit all by itself you can just make an entry in the regular check register like below:

And the Bad Check Holding account is zero. Picture below also shows inside of the bad check register as well

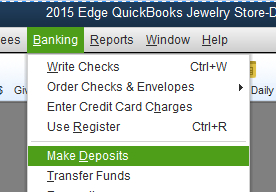

If you charged the customer a fee for your troubles you have to make a deposit with two lines on it. One line is the money reimbursement from the Bad Check Holding Account and the other is “Other Income” which is the fee you’d charge them. Let’s say it’s $35.00. This kind of deposit is done differently

You’d go to the very top “Banking” and choose “Make Deposits:

Fill it in this way.

Go to the last screen for making a deposit the one where you choose the bank account, upper left hand corner.

On the first line choose under “Account” the “Bad Check Holding Account” and in the amount column on the right enter the $777.54. On the second line under “Account” go to the bottom of the chart of accounts and you should find “other income”. Some people might choose “Bank fees” expense because they are getting reimbursed for the fees. Your choice.

What if we never collect on the bad check or the fraudulent credit card?

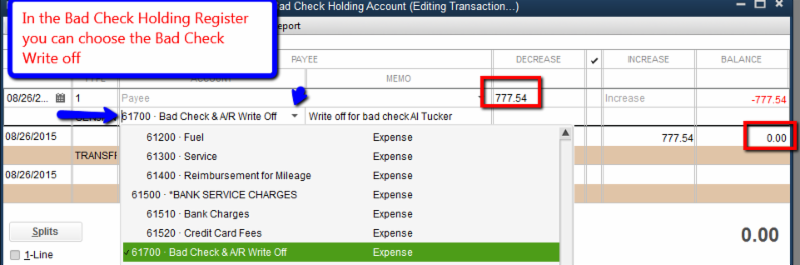

The customer still has the jewelry, nothing happens in the POS system. In our accounting program (QuickBooks) the $777.54 would still be sitting in the bad check holding account because they never paid us back. We would open that register and send that amount to “Bad Debt” expense and we’d get a tax deductible $777.54 write off as an expense this year. At least it lowers our taxable income!

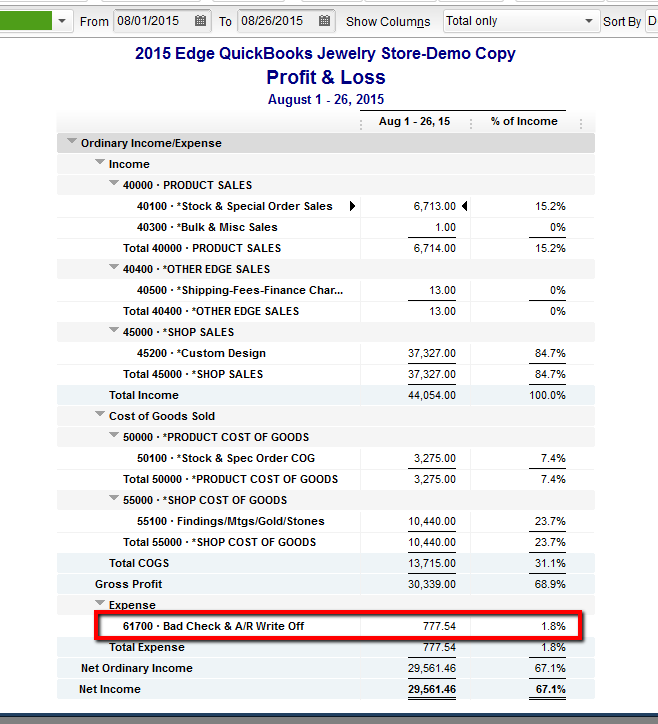

Now on your profit and loss statement you have a write off for $777.54.

Nothing changed in the POS system; Edge; Shopkeeper or any other program.

If you need some help with your QuickBooks at all for:

- Setup

- Connecting QuickBooks to The Edge or Jewelry Shopkeeper for daily easy exporting

- Doing the same correct entries from any other POS program

- Downloading bank transactions right into QuickBooks

- Downloading your American Express, Visa, MasterCard or discover charges right into QuickBooks

- Getting your check accounts reconciled

- Give me a call for a free 30 minute “look-over”.

David Geller

QuickBooks Pro Adviser

QuickBooks Pro Adviser

(404) 255-9565

East Coast 9-5